ETC Proof of Work Course: 15. POW Will Be the Base Layer of the Blockchain Industry

You can listen to or watch this video here

In the previous class, 14, we explained what are reserve currencies and how proof of work (POW) cryptocurrencies such as Bitcoin (BTC) and Ethereum Classic (ETC) will displace current fiat reserve currencies to become the leading forms of money of the future.

In this class, 15, we will go over again the analogies of how POW blockchains will behave as operating systems and will likely become global reserve money, and we will explain how these things will cause these networks to become the base layer, or layer 1 (L1) cryptocurrencies in the industry.

Subsequently, we will argue why we think they will a have the shares they will likely achieve and how this is already happening in the current market.

POW Blockchains As Operating Systems

As we explained in class 13, operating systems are software code that associate the parts of the hardware in which they are installed to the applications used in those devices.

As such, they represent standards that developers of multiple applications and providers can rely on to build their apps so they can be compatible with each other and familiar to all users.

Similarly, blockchains, especially programmable ones, are software systems that represent standards of how accounts, balances, and opcodes must be used by developers for their dapps to interact with each other and for users to find familiar and useful.

Given this status as operating systems but on global peer-to-peer networks, blockchains will likely evolve as such.

POW Blockchains as Reserve Currencies

As we explained in class 14, reserved currencies are a small group of trusted currencies that are widely held globally as stores of value by government treasuries, central banks, businesses, and people in general.

Just as Gold, Silver, copper, and other metals were the money and reserve currencies for centuries in the past, it is very likely that Bitcoin, ETC and other cryptocurrencies, such as Litecoin (LTC) and Monero (XMR), will also occupy that space.

The shelflife left for fiat money is very short because they are managed irresponsibly by their governments, they constantly lose value, and they are absolutely controlled by trusted third parties.

It may take only two or three more decades for hard money cryptocurrency coins to take over as reserve currencies in the world.

The main attraction of these forms of money are not only their hard coded scarcity but that they are trust minimized, so no hegemonic powers can control the financial affairs of other countries and peoples at will.

The Layers of the Blockchain Industry

Just as any technology stack is divided in layers and components, the blockchain industry will be divided in layers and components.

As the volumes managed and technology demands increase and put pressure on the current stack, more and more layers and components will be created to solve various problems that will emerge.

These will range from handling large numbers of transactions to providing adequate security for such volumes, including the underlying accounts, balances, decentralized applications, and significant values at risk.

These pressures will result in a complex ecosystem where each component will complement others and vice versa by providing value where the others can’t.

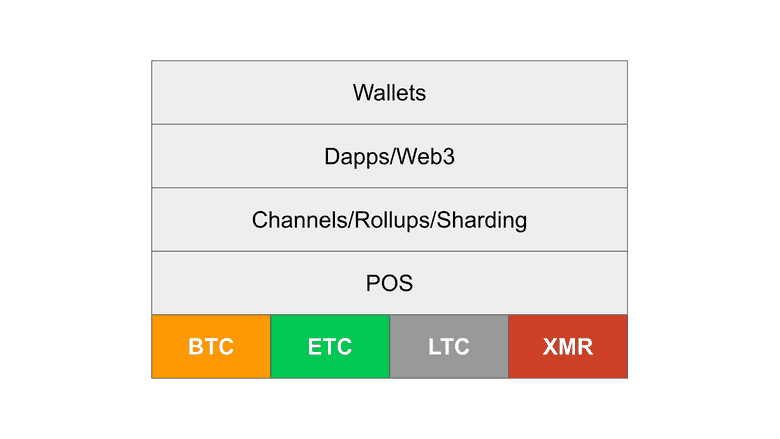

As it can already be seen in the industry, the major layers that are emerging are from base layer blockchains, to proof of stake networks, the channels, rollups, and sharding technologies above them, and then the dapp and web 3 layer, topped by the user interfaces which are usually non-custodial wallets.

Why POW Will be the Base Layer or Layer 1

The reason why POW blockchains will be the base layer or layer 1 of the industry is because financial system technology stacks usually organize themselves by security and scalability levels.

Highly secure objects of value such as gold, silver, or physical cash are usually stored in technologies such as vaults. Then, ledgers and transaction communications systems are created on top so that people and businesses can transfer ownership of these assets through higher layer rails. These rails usually have the capacity to process larger volumes of transactions, but are less secure.

Because POW blockchains, as digital gold, are the most secure and valuable, but are unscalable, then all the other systems will be built on top to be able to provide scalability to the base layer.

What Will be the Size of the Top POW Blockchains

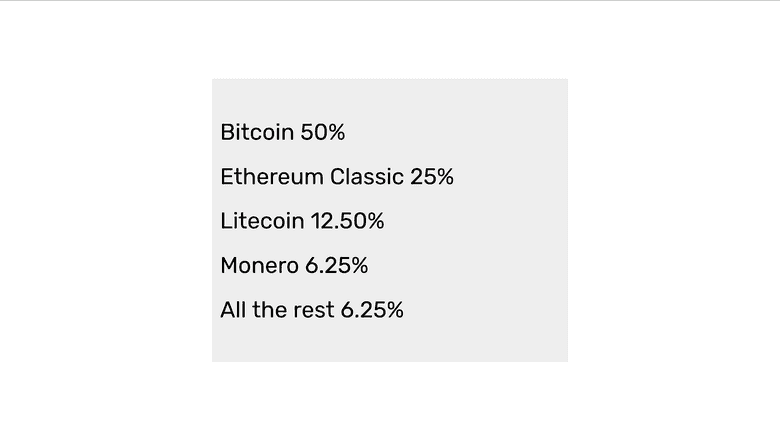

As a simplification, and following the pattern of operating systems and reserve currencies explained in the previous classes, we could say that the largest POW coin, likely BTC, will have around a 50% market share in the segment, then the second one, probably ETC, 1/2 of that or 25%, the next one, possibly LTC, 12.50%, the fourth, maybe XMR, 6.25%, and all the rest the remaining 6.25%.

These very large, unscalable, but very secure base layer blockchains will be the reserve currencies and operating systems of the world and serve as anchors for the whole industry.

On top of these systems Proof of Stake networks may create more scalable and diverse services as second layers that anchor on POW; with channels, sharding, and rollups as third layers; then dapps and web3 applications; and, finally, the wallet brands and other interfaces with end users at the top.

These Trends Are Already Observable in the Blockchain Industry

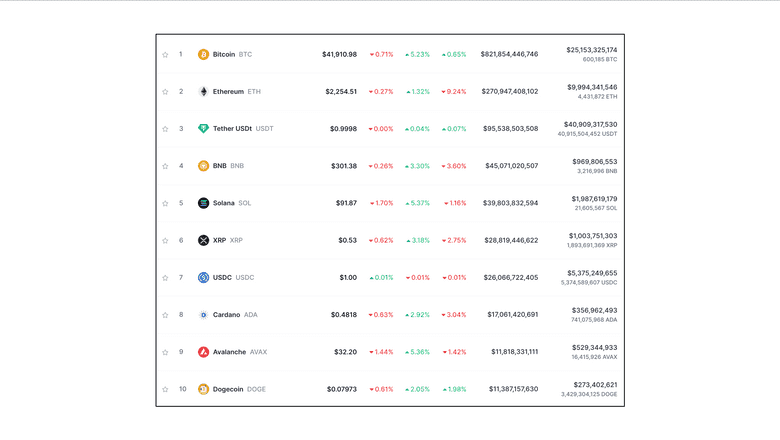

As we mentioned in the previous classes, in aggregate, the trends mentioned in these posts are already observable in the blockchain industry. Bitcoin has consistently had a share of around 50% of the whole market for a long time. Ethereum, as the second largest chain, has had a share of around 25%, and from there on the rest tend to be much smaller, or insignificant.

Thank you for reading this article!

To learn more about ETC please go to: https://ethereumclassic.org